Photovoltaics should not get worse in 2024

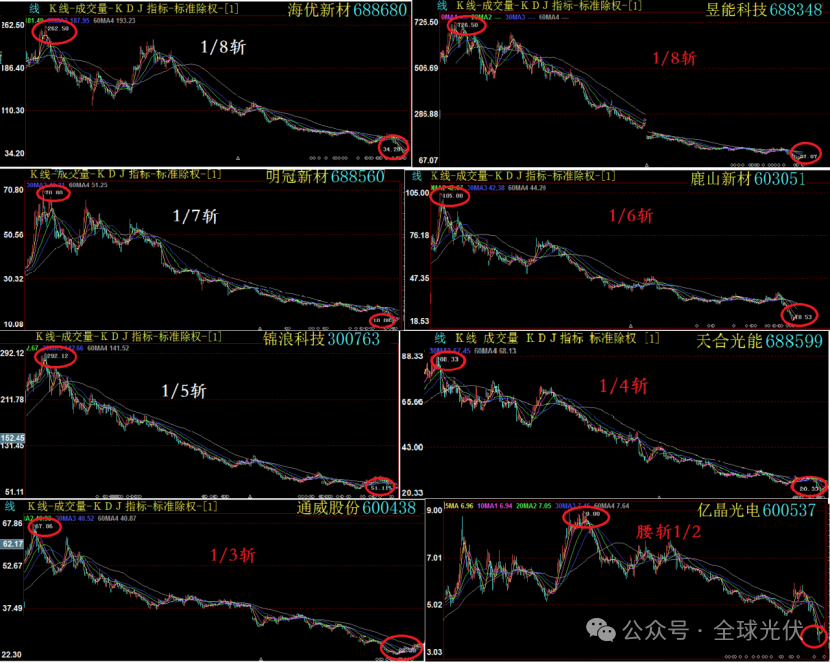

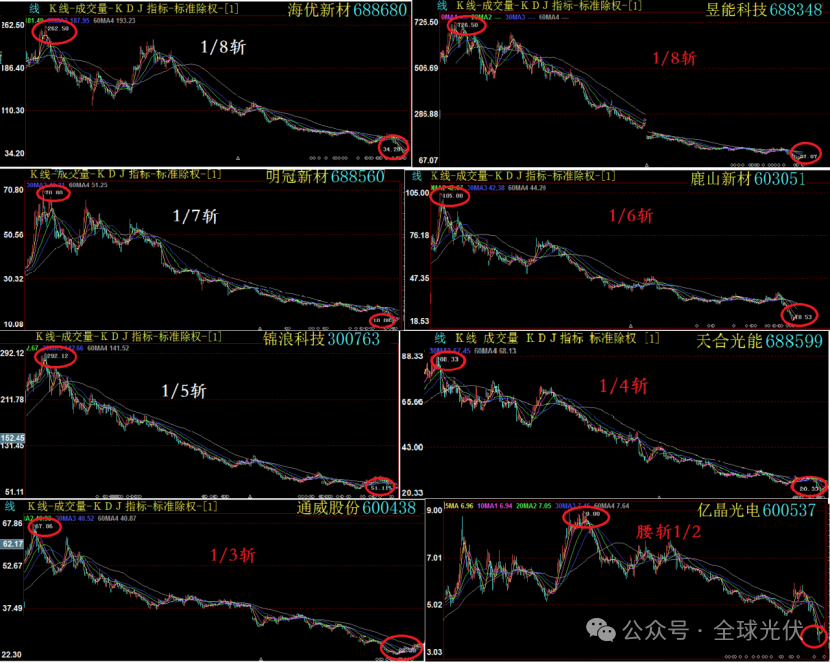

From highs to lows, in the past 2023, how many people’s photovoltaic stocks were cut in half? 1/3 cut? 1/4 cut? 1/6 cut? 1/8 cut?

Recently, Li Zhenguo, President of LONGi Green Energy, said when he was a guest on CCTV’s flagship “Dialogue” New Year’s Eve column: “2024 should not be worse.”

- Silicon material prices have reached rock bottom

The biggest impact on the photovoltaic market in 2023 is overcapacity, especially silicon materials in the second half of the year.

For any industry, the plunge in prices of main materials will affect the bearish sentiment of the entire industry chain. The installed capacity demand in 2023 far exceeds expectations, but it is still unable to match the release of polysilicon production capacity. Therefore, after a brief rebound in the first quarter, silicon material prices plummeted by 70% in the second quarter. Although they stabilized in the third quarter, they entered a downward channel again after demand dropped in the fourth quarter, and prices hit a record low.

Since the second quarter, component prices have plummeted, slowed down, plummeted, and reached record lows, affecting various auxiliary materials such as batteries, film, glass, and frames.

Falling prices can be understood as a bear market in the stock market. At this stage, no one dares to stock up, and even the bidding prices of end owners are attached to the future silicon material market. Today’s inventory will be tomorrow’s losses, and shipping and inventory clearance have become the consensus of the entire industry chain.

When the nest is overturned, there are no eggs left. Although the installed capacity of terminals has hit new highs, all profits in the industry chain have returned to the terminals. In other words, as painful as the terminal owners were with silicon prices in the past two years, they will be happy in 2023.

By the end of 2023, new silicon production capacity will be reluctant or afraid to be put into production. As silicon prices hit a record low in January 2024, the market finally began to stabilize. Corresponding component prices have reached new lows only because some manufacturers have cleared their inventories, and head component manufacturers have begun to call for “keeping calm.”

In this regard, Li Zhenguo said in the “Dialogue” New Year Column that the early price decline has caused many companies to lose money. In the process, strong companies can get through this phase.

If even strong companies cannot survive, this industry will really be gone. It can be expected that the price of the photovoltaic industry chain may continue to decline in 2024, but the “price war” is by no means the main reason. Technology cost reduction will become a mainstream document, and the photovoltaic industry will return to the right track of development.

- The industry bubble gradually fades

The surplus in 2023 will not only be silicon, but also cells and components.

After experiencing shortages and high prices in 2022, and experiencing the innovation and maturity of n-type technology, new cell and component production capacity in the past two years has once again hit a record high.

According to the “Global Photovoltaics” survey, n-type TOPCon technology is an alternative to the PERC technology route. Although shipments in 2023 are only about 100 gigawatts, the industry’s production capacity has reached 500 gigawatts, which is equivalent to all photovoltaic modules in the industry in 2023. Shipments.

In the past three years, cross-border photovoltaic companies, whether they are raising pigs, mining, making medicine, or selling jewelry, have all set their sights on n-type TOPCon or heterojunction technology. By the end of 2023, photovoltaic TOPCon production capacity has been relatively overcapacity by 400%, and the overcapacity rate of heterojunction production is even higher.

But starting from the fourth quarter of 2023, there have been reports that cross-border companies have postponed their plans or given up on cross-border. The plummeting industry profits, excess production capacity, shifting capital interests, and barriers to new technologies have deterred many cross-border players. Even the expansion of production by veteran photovoltaic players has been questioned and questioned by the China Securities Regulatory Commission.

This is true for batteries and components, and auxiliary materials are no exception. Starting from the second half of 2023, the originally crazy expansion of POE film production has gradually declined.

When the industry bubble gradually fades, the water that is not deep cannot cover who is swimming naked. When players no longer go crazy when they lift their pants, the industry will naturally return to rationality.

- Photovoltaic demand continues to rise

In 2023, China’s photovoltaic market set a new record of 216.9 GW of newly installed capacity, with a growth rate of more than 140%, and the growth amount exceeded half of the world’s newly installed capacity.

But it is not just China’s newly installed capacity that is growing rapidly. Among the world’s top three markets, the United States’ newly installed capacity has increased by more than 50%, Europe’s newly installed capacity has increased by nearly 50%, and the global newly installed capacity is expected to grow by 70%.

At the end of 2023, an important reason for not being optimistic about the future of photovoltaics is that: high degree of involution, overcapacity, price decline, technology iteration, etc. have become the keywords of the photovoltaic industry in 2023. So for the year 2024 that has arrived, will it be better than 2023?

At the beginning of 2024, at the energy work conference held by the National Energy Administration, it was clearly stated that China would add approximately 200 GW of photovoltaic and wind power installed capacity in 2024. According to the general conservative style in the past and the radical actions of the photovoltaic industry, 2024 will probably be another year of record highs.

Also in January, the U.S. Energy Agency proposed that the new installed photovoltaic power generation capacity in the power sector in 2024 is planned to be 36.4 GW. If other industrial and commercial photovoltaics planned by the Energy Agency are included, as well as household photovoltaics that are not within the statistical scope of the Energy Agency, the new photovoltaic installed capacity in the United States in 2024 is expected to be around 54 GW, an increase of two-thirds from 2023.

In 2023, India will cause a large number of photovoltaic project delays due to ALMM de facto rules, which will also cause the annual new photovoltaic installed capacity to be lower than the previous year. In Q4 of 2023 and January of this year, India’s New and Renewable Energy Agency announced major benefits. The new ALMM regulations were postponed to April 1, 2024. Prior to this, projects that had been constructed and were under construction, and photovoltaics that had been purchased None of the components are affected by the new regulations. According to industry analysts, this move will allow the accumulated photovoltaic projects to explode in Q1 of 2024. In 2024, India will become the third largest photovoltaic installed country in the world.

In the communiqué of the just-concluded global energy ministers meeting held by the International Energy Agency (IEA), key global goals were once again proposed to triple global renewable energy capacity by 2030 and limit temperature rise to 1.5°C. . Photovoltaics will be the largest contributor to this goal.

- It shouldn’t get worse in 2024

Li Zhenguo said in the “Dialogue” New Year’s Eve column, “In recent years, carbon neutrality has gradually become a new round of international political consensus, and countries have accelerated the process of carbon neutrality. Against this background, the photovoltaic market has exceeded expectations. , rapid development, which has brought about periodic overcapacity.”

But Li Zhenguo believes that although a new round of reshuffle and survival of the fittest in the industry is about to begin, from the perspective of technological development, the photovoltaic industry is getting better; from the perspective of the development cycle stage, the photovoltaic industry should be in In the logic of bottoming out.

“It should not get worse in 2024.” Li Zhenguo said that the current price drop has caused many companies to already lose cash. As an emerging industry, there is no precedent for the development characteristics and pace of technological progress of the photovoltaic industry. In this process, you must be on the right track, grasp your own rhythm, and be neither too radical nor too conservative.

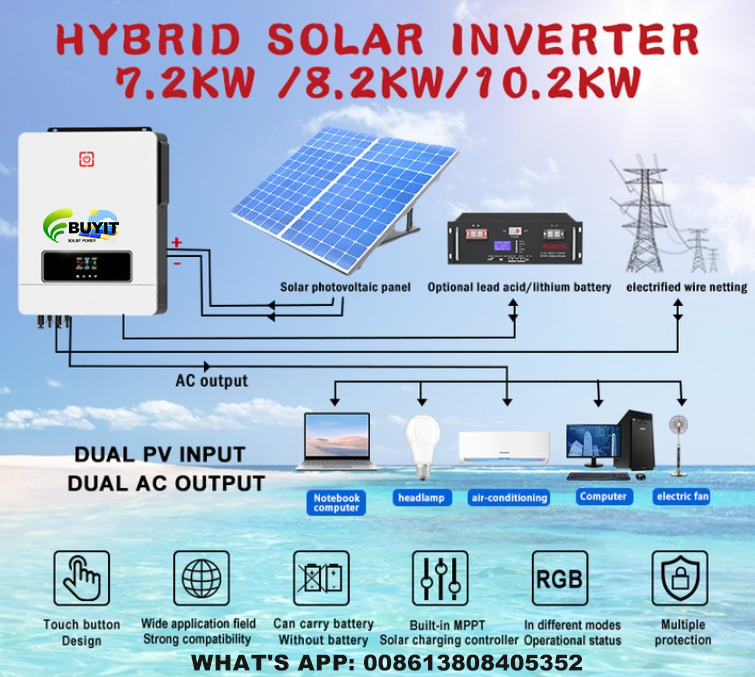

The industry we are engaged in is of great help to the sustainable development of mankind and the living environment of future generations. BUYIT have always maintained firm confidence in the prospects of the photovoltaic industry and are able to concentrate all resources and continue to deepen our efforts in the photovoltaic field! BUYIT will continue to provide you with high-quality services, qualified products, and reasonable prices! Pls call / what’s app: 008613808405352 to get more information!

thanks for read